We can't wait to meet you

AT Bank Board Forum!

SEPTEMBER 8 - 10, 2025 | MARCO ISLAND, FL

Kim Snyder

CEO & Founder

Gill Hundley

Chief Operating & Risk Officer

David Snyder

Chief Financial Officer

Amber Robinson

Vice President, Sales & Strategic Alliances

.png?width=2000&height=83&name=Boxes_Color%20(1).png)

As former bank leaders, we completely understand what insights you need to see and the highly-specific way you want to see them.

We also have the expertise needed to build a unique platform that community bankers across the nation could use to transform their organization.

So, we did.

INTERACTIVE DASHBOARDS

Ditch boring reports, bring your data to life

Empower your team to make informed decisions with self-service access to our 650+ interactive and static dashboards. Say goodbye to complicated reporting processes and hello to actually leveraging the insights within your data.

CUSTOMER-LEVEL DRILL DOWNS

From big picture to transaction level data

Quickly drill down from a macro view all the way to the customer level directly from your interactive dashboard. Instead of sifting through countless reports and making numerous phone calls, spend that valuable time taking action on the data rather than hunting for it.

ENTERPRISE ACCESS

Accurate, centralized data at your fingertips

Gain insights into every aspect of your business, from lending and retail to finance and operations. With enterprise access, you can ensure that everyone in your organization is on the same page with consistent data that can be used to make informed decisions and achieve your bank's goals.

SECURITY FIRST

KlariVis is a security-first organization

The security of your customers' data is a top priority. As former bank leaders, we know what is needed to satisfy regulatory and security concerns. KlariVis maintains robust internal controls based upon strict information security policies and procedures developed and implemented to protect our clients’ data.

+ SO MUCH MORE

Schedule an on-site meeting with our team to learn why KlariVis is the data analytics platform preferred by community banks nationwide!

.png?width=2000&height=83&name=Boxes_Color%20(1).png)

The Truth About Data Quality in Banks: Tools Can’t Fix What People Don’t Own

A robust data platform can transform your bank’s data quality with one specific stipulation: It must be paired with the right top-down approach that encourages and empowers every banker to own the data they use.

Read Now

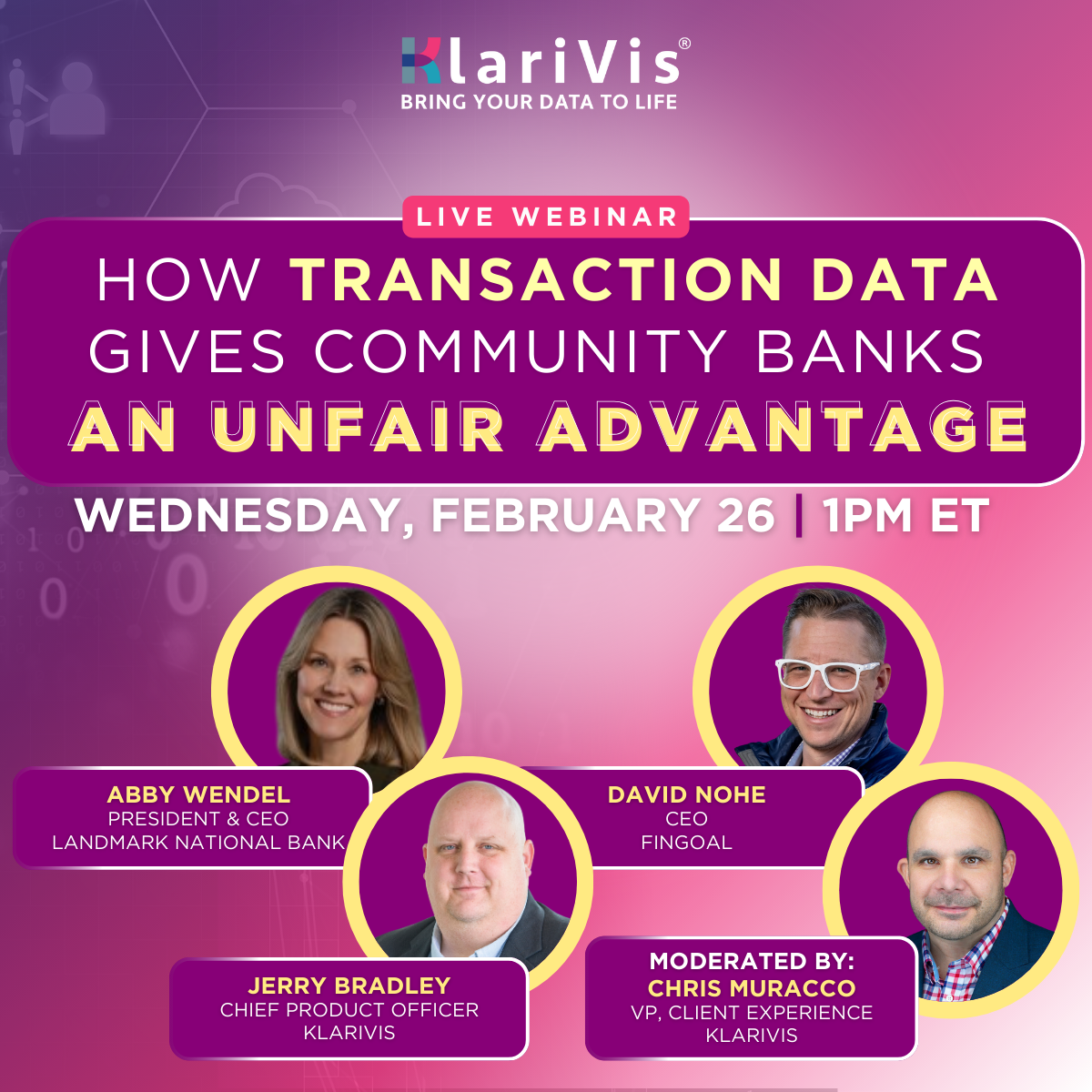

WEBINAR: How Transaction Data Gives Community Banks an Unfair Advantage

Every bank has transaction data – but few use it to their advantage. This discussion will equip you with actionable strategies to turn your bank’s transaction data into a competitive advantage.

Watch the Recording

Optimizing Data Strategy Through Resource Allocation

We’ve often seen that banks will try to add more to improve their data strategy after gaps are identified — more staff, more systems, more enhancements, more data. But doing so can be akin to putting a band-aid on a broken bone if they’re not focusing on the right problem.

Read Now